(20/05/2013)

The Tun-Sei index is a new index developed exclusively in-house and published every month by TUNESS Research Team to provide the latest update on the state of the economy in Tunisia. This Index is constructed based on highly relevant (seasonally adjusted) economic indicators (i.e., Industrial Production, Exports, Bank Loans and International Reserves). This is the first attempt to construct a composite index of the state of the economy in Tunisia which could be used to signal any turning point (e.g., peaks and troughs) in the business cycle. The identified four benchmark indicators used in the model provide valuable information about the current position of the economic activity within the business cycles in Tunisia. The selected indicators cover real sector, financial sector, trade sector and foreign exchange market.

Understanding the state of the economy is a crucial step to facilitate an informed decision-making process for government officials and to provide a reliable anchor to local and international investors in order to elaborate their business forecasts and to make investment decisions. Our present index should therefore provide the necessary “handy summary measure” of the business conditions in the country. In constructing this index, we followed the methodology developed by numerous authors such (Stock and Watson (1989, 1991); Gaudreault, Lamy and Liu, (2003); Gumata, Klein and Ndou (2012); Al-Hassan (2009); Aruoba, Diebold and Scotti , (2009), Fukuda and Onodera (2001) ) and government agencies’ (Federal Reserve, BLS, OECD, European Union, IMF, etc.).

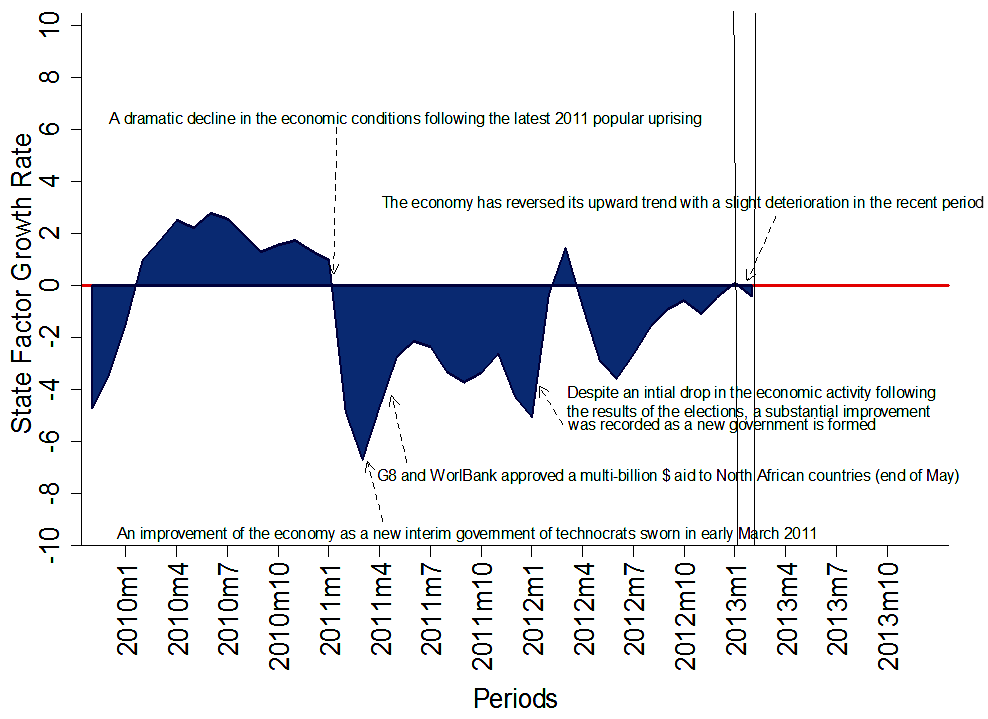

As indicated in the methodology (attached presentation) the long term equilirium (average value of the Tun-Sei) is zero. Positive values (upward trend above the 0 Y-axis) indicate progressively better-than-average conditions, whereas progressively more negative values (dowwand slope) belwo the 0 reference horizontal line, indicate progressively worse-than-average conditions. The model is written in a state space form and estimated using the kalman filter (since the model is linear in the unobserved variable) to construct the Gaussian likelihood function and to estimate the unknown parameters by maximum likelihood.

This index is by no means a final or a cast-in-stone product. On the contrary, such a product will be constantly subject to revisions and improvements particularly in terms of adding new coincident indicators of the business cycle, as they become available.

Index and study prepared by Bechir Bouzid, PhD., TUNESS Research Team.

Presentation and Methodoloy for Constructing the Index.

References:

Abberger, K., and Nierhaus, W., (2011): "Construction of Composite Business Cycle Indicators in a Sparse Data Envirenmet", CESifo WorkingPaper, No. 3557.

Gumata, N., Klein, N. and Ndou, E., (2012): "A Financial Conditions Index for South Africa", IMF WorkingPaper, WP/12/196.

Al-Hassan, A., (2009): "A Coincident Indicator of the Gulf Cooperation Council Business Cycle", IMF WorkingPaper, WP/09/73.

Gaudreault, C., Lamy, R., and Liu, Y., (2003): "New Coincident, Leading and Rcession Indices for the Canadian Economy: An application of the Stock and Watson Mathodology", Canadian Department of Finance, Working Paper 2003-12.

Diebold, F. and Scotti, C. (2009), "Real-Time Measurement of Business Conditions" Journal of Business and Economic Statistics 27:4 (October 2009), pp. 417-27.

Fukuda S, Onodera T. (2001) "A new composite index of coincident indicators in Japan: how can we improve the forecast performance?" University of Tokyo working paper no. 101.

Stock J,& Watson, M.1989. "New Indexes of Coincident and Leading Economic Indicators" NBER Macroeconomics Annual 1989, Volume 4, pages 351-409 National Bureau of Economic Research, Inc.

Stock J,& Watson, M.1990 "Business Cycle Properties of Selected U.S. Economic Time Series, 1959-1988" NBER Working Papers 3376, National Bureau of Economic Research, Inc.

Altissimo, F. Bassanetti, A. Cristadoro, R. Reichlin, L. and Veronese, G. (2001) "The construction of coincident and leading indicators for the euro area business cycle" in Banca d’Italia, Temi di discussione.