TUNESS Chart of the Week (TCW), Friday Jan 11, 2013

The Tunisian banking sector has witnessed successive waves of liberalization starting from mid 1990’s with a noticeable acceleration throughout the last decade. This deliberate policy to increase the competitiveness of this sector by exposing its main actors to foreign players and to provide them with more flexibility in terms of establishing the terms of their credit allocation policy was also accompanied by some regulatory measures (prudential regulation) aiming at reducing any incentive for excessive risk taking

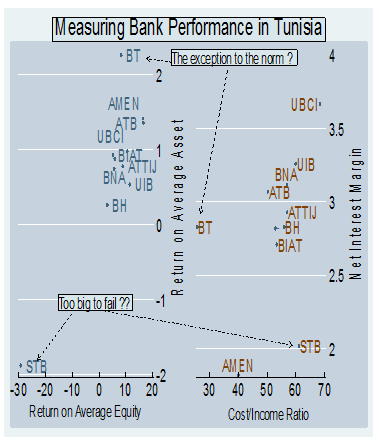

Despite some improvements recorded in certain banking indicators, multiple local and international experts have pointed out the deterioration of the Tunisian banking environment over the last few years due, inter alia, to phenomena such as moral hazard, adverse selection as well as serious agency and the governance problems between various stakeholders. The plotted chart confirms the deteriorating position (albeit not in a critical way) of certain national banks particularly regarding their productivity and efficiency indicators as captured by the Cost Income Ratio with the exception perhaps of the BT (despite its moderate net interest margin). An increase in the administrative costs (labor and material costs) and limited operating revenues (low interest margin and trading results, poorly diversified portfolio of alternative incomes) are often cited as the main causes of the deterioration of the banking sector in Tunisia. State-owned banks such as the STB which has accumulated over the years tremendous amounts of non-performing loans (mainly resulting from bad internal management and constant political interference in the credit allocation policy) appears today to be the front runner in this general weakening of the sector. The low profitability ratios (as captured by the Return on Asset (ROA) and Return on Equity (ROE)) point to poor managerial approaches implemented for years by those institutions in dealing with their respective assets and liabilities. Unfortunately, this brief overview provides yet another gloomy outlook of the instability and uncertainty characterizing the future of some Tunisian banks, unless major structural reforms and the managerial revamps are implemented by their respective stakeholders.

Chart prepared by TUNESS Research Team

Data source: Bankscope database data collected from the 2011exercis